There has been a lot of talk recently about housing affordability in Nevada County (and throughout the rest of California). California has the third most expensive housing costs in the nation, trailing only Hawaii and Washington D.C. So it comes as no surprise that only 31% of those living in Nevada County can legitimately purchase a home here. Which means an even smaller percentage of working class families can buy a house.

That means a huge piece of the American Dream is nearly impossible for them to achieve. That’s why we need Habitat for Humanity.

Nevada County Habitat for Humanity believes everyone should have a decent place to live. A typical family of four we might serve has a household income that ranges between $26,000-58,000 – or 30-80% of the Area Median Income (which is $65,385, U.S. Census Bureau). We call the people in this income range the “missing middle”. They make too much to qualify for most government programs, and not enough to afford market-rate housing.

Nevada County Habitat for Humanity believes everyone should have a decent place to live. A typical family of four we might serve has a household income that ranges between $26,000-58,000 – or 30-80% of the Area Median Income (which is $65,385, U.S. Census Bureau). We call the people in this income range the “missing middle”. They make too much to qualify for most government programs, and not enough to afford market-rate housing.

These are the people who cut your hair, provide daycare, work as grocery store clerks, help you make appointments with your doctors, repair your car and help build local homes. They are also paying 45-65% of their monthly income toward rent (ideally their budget for housing should be 28-32%). The median home price on the market here is over $400,000 – and a minimum mortgage payment will begin at $2,200 or more. What’s even worse for working class families is that a two-bedroom apartment is going to rent for $1,500-1,900 per month (if one can be found).

This is a problem. If these families can no longer afford to live here, they will move out of Nevada County where there are more jobs and more reasonable and affordable housing costs. The last thing they, and the apartment owners, need is to have to seek advice from the AAOA. Things should be fairer.

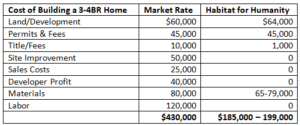

They need our help to stay in this community they love! The economic model we use is pretty simple. Homeowners pour 500 hours of “sweat-equity” into the building of their home and then take on a zero-interest mortgage. We keep the overall cost of the home down by implementing the Habitat formula: zero interest loan + all volunteer labor = an affordable mortgage payment. Here’s how the formula pens-out (a mighty thanks to Barbara Bashall, Nevada County Contractors Association for the estimated costs to build a market rate home. These figures were published in The Union on March 3, 2019):

While this isn’t an apples-to-apples comparison (it’s close – both depict a 3-4BR home with the market rate home being a bit larger), this gives you a good idea how the Habitat model works. First thing to note is that NCHFH’s up-front costs for land and permits/fees are nearly identical. Before we hammer a single nail we’ve spent $70,000.

Next, the cost of materials is relatively the same, however, as a nonprofit organization we can accept in-kind contributions of materials and even specialized labor (like installing a roof). To underscore this, being a part of an international brand has some advantages. Through an agreement with Habitat International, Whirlpool donates all of the kitchen appliances (stove, dishwasher, microwave). And locally, Byers has donated the material and labor to install rooves on a number of Habitat homes.

The most obvious differences are in the areas of profit, marketing and labor. Our crew of volunteer construction workers is what separates Habitat from every other builder – be they a private developer or a nonprofit. We also couldn’t do this without generous donors. They know that 100% of their gift goes directly into the building of the homes – none is spent on overhead costs.

The most obvious differences are in the areas of profit, marketing and labor. Our crew of volunteer construction workers is what separates Habitat from every other builder – be they a private developer or a nonprofit. We also couldn’t do this without generous donors. They know that 100% of their gift goes directly into the building of the homes – none is spent on overhead costs.

Before we build a home the homeowner family is selected. By doing this, the home fits the family versus fitting a family into an existing home. During the 6-9 months it takes to build their home, the homeowner is out there suited-up working alongside our seasoned crew members, hammering nails and installing insulation. We don’t market the homes (so we have no marketing costs. Yes, there are fundraising costs, but those are covered by our sustainable sources of revenue from ReStore and mortgage payments. Like we promise, 100% of a donation goes into the home).

Finally, the zero-interest loan keeps the mortgage payment reasonable. Essentially the cost of land, infrastructure and materials is spread over 25-30 years.

The end-result of this process? A single mom with two kids can afford to own a home, with a mortgage payment (plus property taxes/insurance) ranging between $550-850 per month.

The combination of hard-working volunteers, faithful donors, a generous business community and a huge dose of love-in-action is how Habitat for Humanity keeps the American Dream accessible for working class families. That’s the secret to our formula.