Maximize Your Philanthropic Goals

The easiest way to make an impact...Join Our Legacy Builders Circle!

Plan Now. Give Later.

Interested in giving to Nevada County Habitat for Humanity but feel overwhelmed by the thought of writing another check or giving up your assets today? A simple, flexible and versatile way to ensure your charitable intentions continue for years to come is a gift in your will or trust, known as a charitable bequest.

A bequest is one of the easiest gifts to make. With the help of an advisor, you can include language in your will or trust specifying a gift be made to Nevada County Habitat for Humanity as part of your estate plan (see our sample bequest language below).

A charitable bequest to Nevada County Habitat enables you to retain control over your assets during your lifetime and support the community you love later. Nevada County Habitat Tax ID: 68-0383595

Leave a Lasting Legacy

What assets can you use?

You can use the following assets for a charitable bequest: Cash, Appreciated Securities, Real Estate, Tangible Personal Property, and Closely Held Stock.

What are the benefits of your bequest?

Benefits include receiving an estate tax charitable deduction, lessening the burden of taxes on your family, and leaving a lasting legacy.

What are your bequest options?

A bequest may be made in several ways, including: a gift of a percentage of your estate, a gift of a specific dollar amount or asset, or a gift from the balance or residue of your estate.

What about Beneficiary Designations?

You can name us beneficiary of the following assets: retirement plan assets, life insurance, commercial annuities, bank accounts, and certificates of deposit or brokerage accounts.

How easy are Beneficiary Designations?

Not only is it an easy way to give, but it’s also flexible — you aren’t locked into the choices you make today. You can review and adjust beneficiary designations any time you want.

How It Works

Charitable Bequest

A charitable bequest is language in your will or trust that leaves to Nevada County Habitat a specific item, an amount of money, a gift contingent upon certain events or a percentage of your estate. By including a bequest to us in your will or trust, your gift entitles your estate to maximum charitable tax deductions afforded by federal law.

Beneficiary Designations

You can also support Nevada County Habitat with our mission after your lifetime with a beneficiary designation. Just name us as a beneficiary to receive assets such as retirement plans and life insurance policies after you’re gone. You simply fill out a form that is entirely separate from your will—which makes this approach an easy way to give.

Consult a Tax Expert

The information here is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Any references to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your results.

How do I make a bequest?

An excellent way for you to support Nevada County Habitat’s mission is to leave us a bequest in your will, living trust or with a codicil. One significant benefit of making a gift by bequest is that it allows you to continue to use the property you will leave to charity during your life. Another benefit is that you are able to leave a lasting legacy.

If you have included a bequest for Nevada County Habitat for Humanity in your estate plan, please contact us to let us know. We would like to thank you and recognize you for your gift!

Types of Bequests

There are a number of ways you can make a bequest to Nevada County Habitat for Humanity.

Specific Bequest. A specific bequest involves making a gift of a specific asset such as real estate, a car, other property or a gift for a specific dollar amount. For example, you may wish to leave your home or $10,000 to Nevada County Habitat.

Percentage Bequest. Another kind of specific bequest involves leaving a specific percentage of your overall estate to charity. For example, you may wish to leave 10% of your estate to Nevada County Habitat.

Residual Bequest. A residual bequest is made from the balance of an estate after the will or trust has given away each of the specific bequests. A common residual bequest involves leaving a percentage of the residue of the estate to charity. For example, you may wish to leave 30% of the residue of your estate to Nevada County Habitat.

Contingent Bequest. A contingent bequest is made to charity only if the purpose of the primary bequest cannot be met. For example, you could leave specific property, such as a vacation home, to a relative, but the bequest language could provide that if the relative is not alive at the time of your death, the vacation home will go to Nevada County Habitat for Humanity.

Bequest Facts

A bequest is generally a revocable gift, which means it can be changed or modified at any time. You can choose to designate that a bequest be used for a general or specific purpose so you have the peace of mind knowing that your gift will be used as intended. Bequests are exempt from federal estate taxes. If you have a taxable estate, the estate tax charitable deduction may offset or eliminate estate taxes, resulting in a larger inheritance for your heirs.

Specific Bequest Language

If you are considering making an outright bequest to Nevada County Habitat for Humanity, we recommend the following language:

Bequest of a Specific Dollar Amount

I hereby give, devise and bequeath _________ and No/100 dollars ($DOLLARS) to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, for Nevada County Habitat for Humanity’s general use and purpose.

Bequest of Specific Personal Property

I hereby give, devise and bequeath DESCRIPTION OF PROPERTY to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, for Nevada County Habitat for Humanity’s general use and purpose.

Bequest of Specific Real Estate

I hereby give, devise and bequeath all of the right, title and interest in and to the real estate located at ADDRESS OR DESCRIPTION OF PROPERTY to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, for Nevada County Habitat for Humanity’s general use and purpose.

Percentage Bequest Language

If you are considering making a bequest of a percentage of your estate to Nevada County Habitat for Humanity, we recommend the following language:

I hereby give, devise and bequeath ____ percent (___%) of my total estate, determined as of the date of my death, to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, for Nevada County Habitat for Humanity’s general use and purpose.

Residual Bequest Language

I hereby give, devise and bequeath to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, ALL OR A PERCENTAGE of the rest, residue and remainder of my estate to be used for Nevada County Habitat for Humanity’s general use and purpose.

Contingent Bequest Language

If (primary beneficiary) does not survive me, then I hereby give, devise and bequeath to Nevada County Habitat for Humanity, a nonprofit organization located at 236 S. Church Street, Grass Valley, CA, 95945, Federal Tax ID #68-0383595, DESCRIPTION OF PROPERTY to be used for Nevada County Habitat for Humanity’s general use and purpose.

Thank you!

“I always felt like education was my bright star at the end of a dark tunnel,” Sharon tells us. After graduating from Nevada Union in 2000 she started a nursing program, but had to quit when she had significant complications during her pregnancy with her first child. She eventually returned to school, but has been able to only take a class or two at a time because of her need to care for her children and to work. But she won’t ever give up.

“I never dreamed having a Habitat for Humanity home would be possible — but it is! We’ve been provided a surprise light! Just knowing I’ll have a safe place to call home, where I can hear my children laughing and playing in the back yard, my heart is filled with gratitude.”

Impacting Lives

“During the five years in our Habitat home my faith has strengthened, especially in myself. Our lives have changed exponentially. This truly is a ‘forever home’ for us.” —Corinne

“I know it’s an overused phrase, but this was a real dream come true for me. And the dream for my children came true. For the first time in my life I have a future with ground under my feet that won’t disappear.” —Nicole

“Through Nevada County Habitat for Humanity I was given the tools and opportunity to succeed and the stepping stone to advance our lives. My Habitat home was a real, solid and safe place for me and my family.” —Amanda

Make a Gift of Appreciated Stock

Generating a return for your community.Also, IRAs can qualify for tax-free charitable contributions.

Gift of Appreciated Stock

Turning stock market gains into community investment.

Everybody wins when you make a gift of appreciated stock to Nevada County Habitat for Humanity. Your gains are put to good use. Your gift of stock is reinvested in your community, and it qualifies for an immediate tax deduction based on the full fair market value. Nevada County Habitat Tax ID: 68-0383595

A popular means of giving back.

Gifts of appreciated securities provide tax advantages.

If you have held the securities (stock, bonds, and most mutual funds) for one year or longer, the current value of the securities is tax deductible to the extent of 30 percent of your adjusted gross income.

Deduction amounts exceeding this limit may also be carried forward for additional years.

You do not have to pay federal or state capital gains taxes on the appreciated portion of the gift.

The fastest and easiest way to make a gift of stock is to have your broker perform an electronic transfer.

If you make a gift of securities, please contact us at 530-274-1951 so we can acknowledge your gift in a timely manner.

What else may be accepted as a donation?

Gifts of closely-held stock, Limited Partnership Shares, or Limited Liability Company Interests may be accepted by Nevada County Habitat for Humanity as well.

The information here is not intended as legal or tax advice. For such advice, please consult your attorney or tax advisor.

If you have questions or need assistance, please call us at (530) 274-1951.

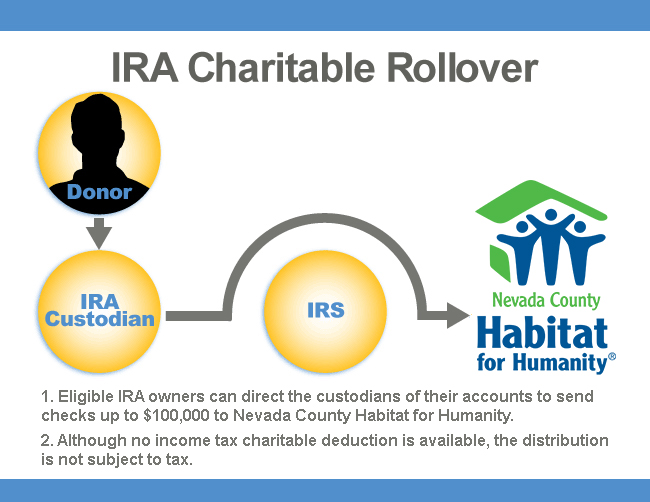

IRAs can qualify for tax-free charitable contributions

Nevada County Habitat for Humanity can help turn your individual retirement accounts (IRAs) into tax-saving charitable gifts. Extended tax benefits allow more people to experience the joy of giving during their lifetimes.

You can give more for less.Thanks to the new legislation, American seniors can make the gift of a lifetime by giving their IRAs to charity without federal tax penalty. So your retirement funds can go further than ever before.

For years, estate planners have recommended that retirement assets may be the most tax-effective asset in larger estates to distribute to charity. These assets are not only vulnerable to heavy taxation as part of an estate but also can be taxed again as income in respect to a decedent on the tax returns of heirs.

Until recent legislation, there was a disincentive for retirees to give IRAs to charity during their lifetimes because withdrawals from IRAs were subject to income tax—even those given to charity.

Annually, retirement assets may become a preferred charitable gift for seniors. IRA distributions to charity can receive special tax advantages. Americans age 70½ and up can make tax-free IRA contributions to public charities.