Home Buyer Program

Nevada County Habitat for HumanityLooking for an opportunity to buy an affordable home?

Informational Meetings

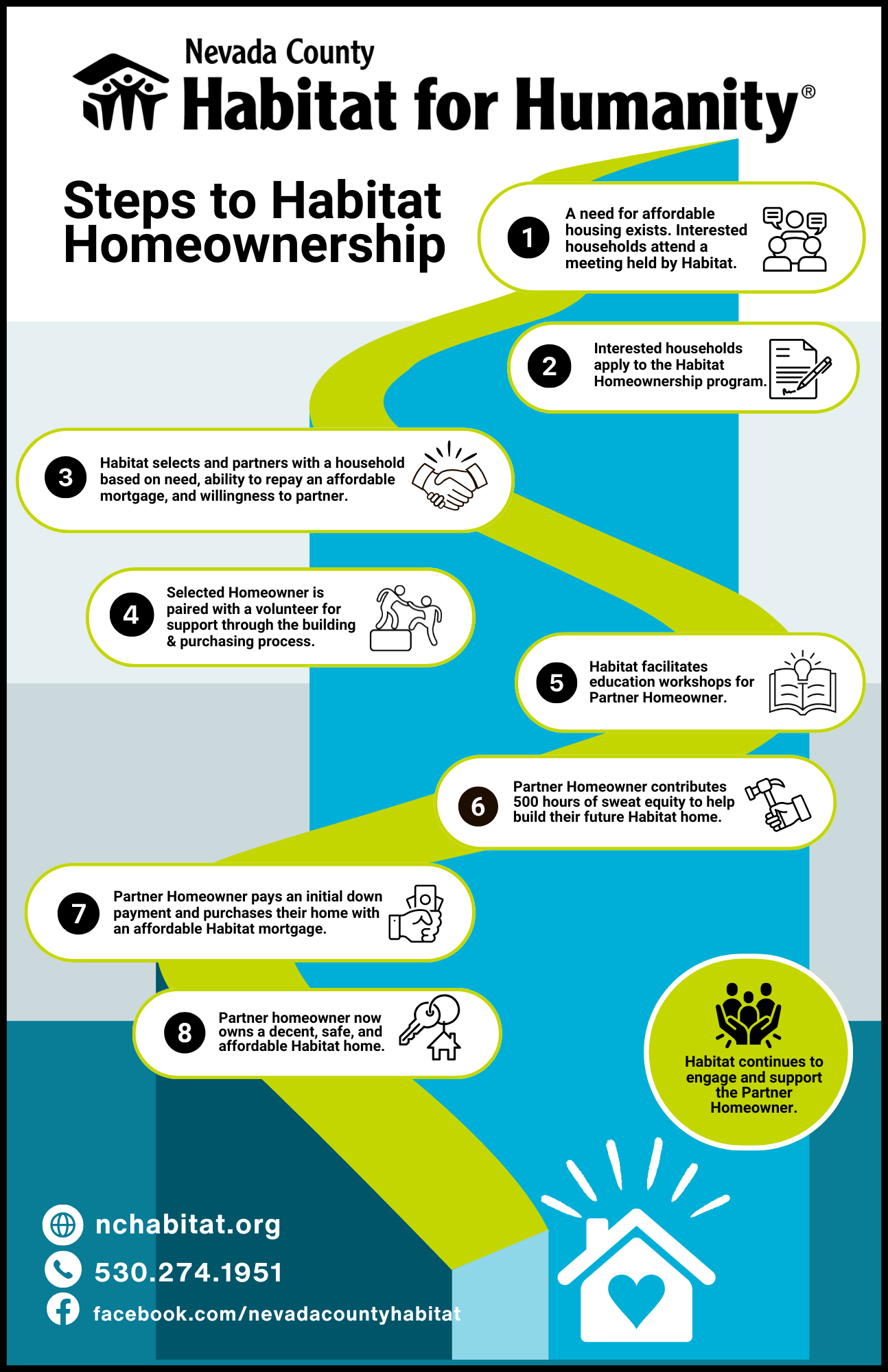

A series of public informational meetings are held periodically by our Homeowner Selection Committee when we are ready to accept applications for our next homes. At the orientation meeting qualifications for the program are reviewed and application packets are distributed. The applicants are given ample time to provide the required information and do not need to provide anything in advance of the meeting.

Basic Guidelines

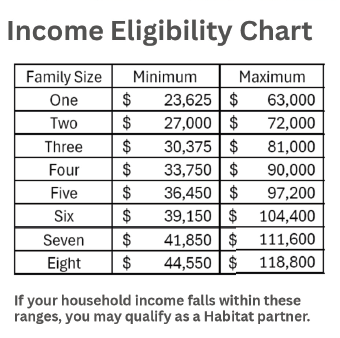

Please review the basic guidelines for eligibility, qualifications, and expectations for becoming a Habitat Homeowner. We will look at three distinct areas of selection criteria when reviewing potential homeowners.

Your household's actual housing need based on the suitability of your current housing.

Your current income and ability to pay for a Habitat home.

Your willingness to participate as a partner with Habitat, which includes your assistance in constructing your home and the homes of others (sweat equity).

Homeowner Selection

Please read the information regarding our Homeowner Selection Criteria. If you feel that you meet these criteria and would like to attend a public informational meeting as described above, please contact the NCHFH office to sign up or complete the request form below. When we receive your completed form, we will keep it on file in order to notify you by mail of the time and location of the next orientation meeting.

The selection of applicants who will purchase homes from Nevada County Habitat for Humanity will be done by the Homeowner Selection Committee using these criteria in a way that does not discriminate on the basis of race, sex, color, age, handicap, religion, marital status, or because all or part of the applicant’s income is derived from public assistance.

A) Need

1. Unable to obtain adequate housing through other conventional means...

You will be considered for a Habitat home if you are unable to obtain adequate housing through other conventional means and your present housing is not adequate. Inadequate housing may include any of the following: physical condition of rental, unaffordable rent based on income, and overcrowded for house hold size. Overcrowding and unaffordable rent is also taken into consideration based on the number, ages and gender of household compared to the number of bedrooms in your home.

2. The percentage of your monthly income that you currently spend on housing...

The percentage of your monthly income that you currently spend on housing is considered to determine need. You will be required to openly and fully discuss your financial situation with a Habitat interviewer.

3. Your total income is at least the minimum required...

You and your family will be considered if your total income is at least the minimum required and not more than 60% of median household income for Nevada County. (HUD 2017 figures adjusted for household size).

B) Ability to Pay

Since you will actually be buying your home from Habitat, you must demonstrate your ability to pay the monthly mortgage payment.

This monthly payment will include a payment on the principal mortgage note (which it is important to remember can be sold to a note investing firm such as Amerinote Xchange later down the line), a payment for property taxes and homeowners

insurance. We will help you determine if this payment will jeopardize your ability to meet all your other family financial obligations and

expenses. We can also help you if you need to develop a budget to determine your eligibility.

For the formal application process, Habitat will need:

Tax Returns

Copies of state and federal income tax returns with W-2 forms for the last 3 years.

Bank Statements

Copies of current statements for bank accounts, stock or mutual funds that you or co-applicant own.

In Nevada County

List of employers and landlords for past 2 years. Please note: You must work or live in Nevada County to apply for a Habitat home in Nevada County.

C) Willingness to Participate as a Partner with Habitat

Sweat Equity

If selected, you become a “partner” in the Habitat program. Your assistance in constructing your home and the homes of others is called “sweat equity.” Your volunteer “sweat equity” contribution of 500 hours must be completed before purchasing your home.

#1

More Details

Sweat equity includes helping with construction, and may include other activities such as working in the Habitat office, helping with events, and assisting at the ReStore. Friends and relatives may volunteer time on your behalf that can be applied to your 500 hours of “sweat equity”: up to 20% (100 hours) for a 2-adult household, or up to 40% (200 hours) for a single adult household.

Responsible Homeowner

You will be responsible for maintenance and repairs of your home from the time you purchase. Willingness to be a responsible neighbor, including respect and consideration for your property, our neighbors and your neighborhood.

#2

Homeowner Support

After moving into your home, the Homeowner Support Committee will maintain an ongoing relationship with you. This includes financial counseling and household maintenance education.

#3